Thinking of buying real estate? First time home buyers have concerns about their credit score…What will the lender find when they run the credit report? What really determines your credit score?

Hope this helps…..

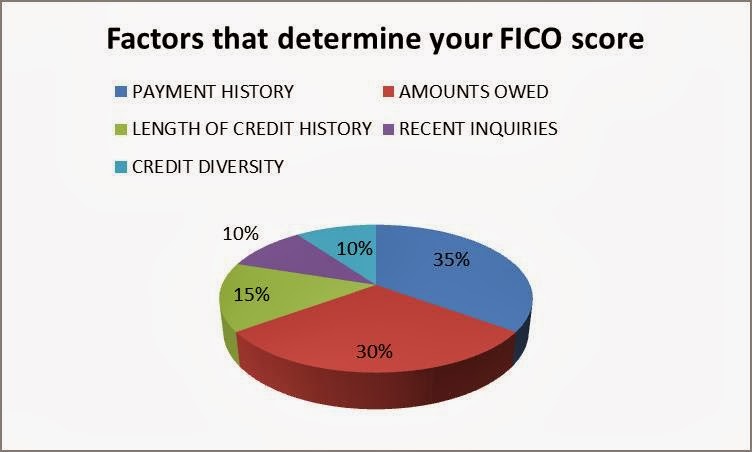

35% PAYMENT HISTORY The largest factor is your basic payment history. This is the number of unpaid bills that you have, any bills sent to collection, bankruptcies, etc. The items that are most recent have the most impact.

30% AMOUNTS OWED Are your credit cards maxed out? High balances, or balances close to your credit limit can negatively affect your score. Keep balances below 35% of your credit limit.

15% LENGTH OF CREDIT HISTORY How long have your accounts been open? The longer the account has been open, the better.

10% RECENT INQUIRIES Every time you apply for credit of any kind, you create an inquiry on your credit report. Multiple inquiries negatively affect your score.

10% CREDIT DIVERSITY There are 3 account types that can be listed on your report. They are mortgage, installment, and revolving accounts. The more diverse your accounts, the higher your scores.

Information courtesy Michael Lamborn-Coldwell Banker Realty Home Loans

If you are a Buyer you will want to read my Blog on “How to maintain or improve your credit score” https://belavorahomes.com/2022/04/how-to-maintain-or-improve-your-credit-score

If you are a Buyer looking to move to Chester County contact me. Check out my Client Testimonial page to read what my clients have to say.

Check out info on local communities in Exton, 19341, Chester Springs, 19425, Downingtown, 19335 in the Philly Suburbs area https://belavorahomes.com/communities

Not local to Philly, but still looking to sell or buy? Connect with me for a trusted Realtor referral in your area!

Bela Vora, Realtor

Cell : 484 947 3127

Office: 610 363 6006

Email: bela@belavora.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link